🟣 Introduction

Altseason is a special period in the cryptocurrency market when alternative cryptocurrencies (altcoins) — meaning all coins except Bitcoin — demonstrate stronger growth and profitability than Bitcoin itself. Traditionally, this happens through a capital shift: investors take profits in BTC and move them into altcoins, which triggers a rapid price increase.

🔤 What is “Altseason” (Etymology)

The term comes from English: altcoins — “alternative coins” (alt = alternative, coin = currency).

“Altseason” refers to a period of active growth of altcoins compared to Bitcoin. This usually follows after a significant BTC rally or stabilization, when investors start looking for riskier but potentially more profitable crypto assets.

🟣 What are Altcoins?

- Ethereum (ETH) — the “world computer” of blockchain (smart contracts).

- Solana (SOL) — high throughput for dApps and DeFi.

- Cardano (ADA) — a research-driven project.

- Dogecoin (DOGE) — a meme coin that gained mass popularity.

- Polygon (MATIC), Avalanche (AVAX), Chainlink (LINK) and many others are also altcoins.

🍌 Altseason Explained Simply (Analogy)

Imagine a big fruit market:

- Bitcoin = bananas: the most popular and familiar, bought by nearly everyone.

- Altcoins = oranges, strawberries, exotic fruits: less known, but sometimes more valuable.

Normally, people buy bananas first (Bitcoin), then try other fruits (altcoins).

Altseason is when people start massively buying not just bananas, but also other fruits. Prices of these “fruits” (alts) rise much faster.

🔎 How It Works in Practice

- Bitcoin rallies → the market heats up, media and investors pay attention.

- Profit-taking → investors sell part of BTC and search for new growth opportunities.

- Capital rotation → money flows into altcoins, which often rise much faster (sometimes ×10 or more).

- Peak hype → newcomers flood in, buying alts, pushing prices even higher.

📊 Real Examples

- 2017: BTC rose from ~$1,000 → ~$20,000. ETH grew from ~$8 → ~$1,400. Many ICO tokens gave ×50–×100 returns. BTC dominance dropped from ~87% → ~35%. Classic altseason.

- 2021: BTC hit ~$69,000. Solana (SOL) jumped from ~$2 → ~$250; Cardano (ADA) from $0.03 → ~$3; Dogecoin (DOGE) from fractions of a cent → ~$0.7. Altcoins grew stronger than BTC.

If you only held BTC, you still earned well. But altcoins could bring far higher returns.

⚠️ What Happens After Altseason

- When hype fades, altcoins often fall harder than BTC.

- Example: after 2017, many projects dropped by 90–99%.

- Conclusion: Altseason offers huge profit potential but also very high risks if gains are not secured in time.

📈 Signs of Altseason

- ⬇️ Declining Bitcoin dominance (below ~40%).

- 🚀 Mass rallies of altcoins (hundreds of % gains).

- 💹 Rising total altcoin market cap.

- 👥 Growing investor interest and influx of new users.

- 🔁 Higher trading volumes and volatility.

🧮 Altseason Index

A conditional index that measures altcoin vs BTC performance in the past ~90 days.

- If >75% of major alts outperform BTC → Altseason.

- If the opposite → “Bitcoin season.”

(Different services may use their own variations of this index.)

📌 Why Altseason Matters

It is a time of great opportunity for traders and investors to maximize profits. But risks are equally high — altcoins can crash just as fast as they rise.

The key: avoid panic or FOMO (fear of missing out) and use proper analysis and risk management.

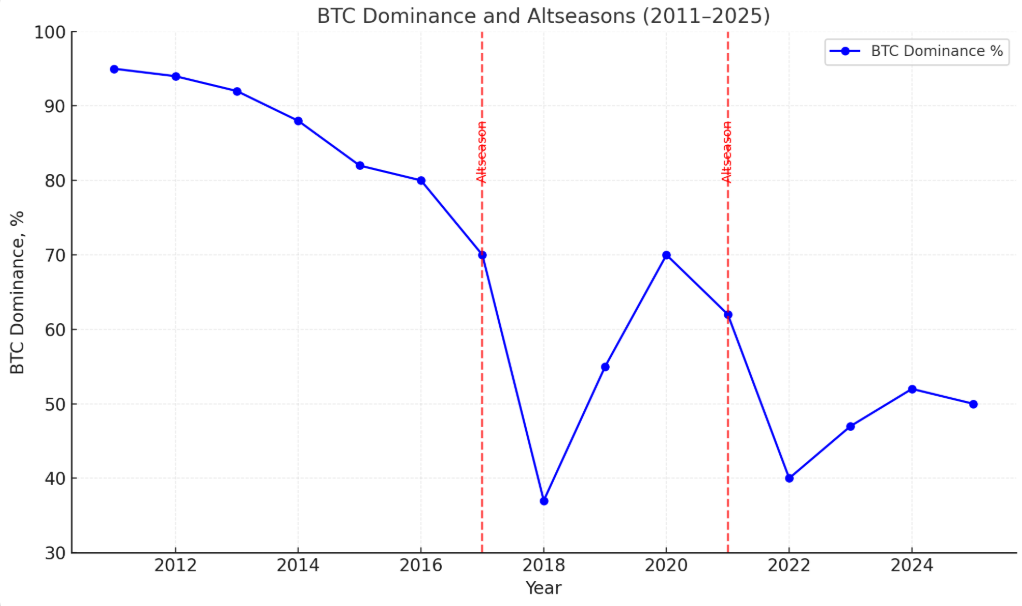

🕰 History of the Last 15 Years

- 2011–2013: Birth of alts

First alternatives appeared: Litecoin (2011), Ripple (2012). BTC dominance ~95%. No real altseason yet. - 2014–2016: Early spikes

Ethereum (2015), Monero, Dash, Dogecoin launched. BTC dominance fell to ~80%. Some mini-altseasons occurred. - 2017: The classic altseason

ICO boom. ETH and many tokens surged. BTC dominance collapsed from ~87% → ~35%. - 2018–2019: Bear market

Heavy crash. Many alts lost 90%+. BTC regained dominance >70%. - 2020–2021: DeFi & NFT boom

DEX, lending, NFTs expanded. ETH and top alts hit new ATHs. Many small coins made ×10–×50 gains. BTC dominance fell below 40%. - 2022: Crypto winter

Terra (LUNA/UST) collapse, FTX and Celsius bankruptcies. Altcoins hit harder than BTC. - 2023–2024: Recovery & new narratives

AI tokens, Layer-2 (Arbitrum, Optimism), RWA (real-world asset tokenization). Sector-specific rallies but no global altseason. - 2025: Waiting for the next cycle

With BTC and ETH spot ETFs, investor interest in alts grows. BTC dominance ~50%+. Possible future capital rotation into alts (DeFi 2.0, AI, GameFi, RWA).

✅ Conclusion

Altseason is a cyclical market stage where investor focus and capital shift from Bitcoin to alternative projects. It brings both unique opportunities and risks.

Historically, the largest altseasons occurred in 2017 and 2021, usually every 3–4 years within bull cycles.

🛡 Practical Checklist for Participants

- Diversify — don’t go all-in on one coin.

- Use stop-losses and take-profit levels.

- Do fundamental research (team, tech, tokenomics).

- Avoid FOMO — set clear limits and rules.

- Remember: fast growth → high volatility → risk of sharp pullback.

⚡️ This article was translated into English using AI.

© 2025 OdaNoder. Republishing and quoting are allowed only with an active link to the source.

cryptocurrency #altseason #bitcoin #ethereum #investing #DeFi #finance #trading #blockchain #cryptomarket